Contents:

If the estate includes property that was inherited from someone else within the preceding 10 years, and there was estate tax paid on that property, there may also be a credit for property previously taxed. Click here to see the states with the highest property taxes. The value of some operating business interests or farms may be reduced for estates that qualify. Massachusetts also has an estate tax at a top rate of 16% on estates valued at more than $1 million.

Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person’s life. Data from the Tax Foundation, an independent non-profit tax policy research organization, 24/7 Wall St. identified the states where people pay the most in property taxes. States are ranked by the effective property tax rate, or the average amount paid in property taxes as a share of property value in 2021.

A 5% discount is allowed if the tax is paid within three months of the decedent’s death. The tax isn’t scary at all for the decedent’s spouse, parents, children, grandchildren and siblings. The scoring formulas take into account multiple data points for each financial product and service. There’s still time to get your taxes done right with Harness Tax.

Texas House passes $12 billion property tax relief package, setting up fight over appraisal cap with Senate

Property taxes are collected in all 50 states and the District of Columbia and are a key source of local government revenue. Governments use property taxes to fund schools, roads, parks, public transportation and payroll for municipal employees. While the use of terms like “death duty” had been known earlier, specifically calling estate tax the “death tax” was a move that entered mainstream public discourse in the 1990s. This happened after a proposal was shelved that would have reduced the threshold from $600,000 to $200,000, after it proved to be more unpopular than expected, and awakened political interest in reducing the tax. Surveys suggest that opposition to inheritance and estate taxes is even stronger with the poor than with the rich. Congress enacted a “duty or tax” with respect to certain “legacies or distributive shares arising from personal property” passing, either by will or intestacy, from deceased persons.

- Below are some of the more common questions and answers about Estate Tax issues.

- With the effective property rate in this state at 0.56%, residents can enjoy more time outdoors and less financial stress.

- For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

- Oregon has resisted the trend to raise its estate tax exemption .

- Be forewarned that estate taxes are very complicated, and if you’re navigating state statutes and rate tables, you’ll often benefit from the help of a tax professional or estate lawyer.

They may include income taxes, sales and excise taxes, inheritance taxes, estate taxes, and gift taxes. Federal estate taxes apply to estates worth more than $11.7 million as of 2021. Because these taxes vary by state, location plays a key role in how much an estate and the beneficiaries of an inheritance pay.

wave accounting taxes can make a big difference when it comes to affordability. Get preapproved now so that you have all the info you need to make an informed decision while house hunting. California has the highest income tax, followed by Hawaii and New Jersey. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. The state offers an additional $2.5 million deduction for family-owned businesses valued at less than $6 million.

Wealth Tax Proposals Are Back as States Take Aim at Investment

In some states, senior citizens are exempt from paying property taxes. Depending on the state, this may be a designation for those aged 62, 65, or older. Active members of the military and veterans are often eligible for tax exemptions, the details of which vary broadly by state. Disabled veterans, surviving spouses, or surviving children may also qualify for special exemptions.

Coming in at No. 3 on our list, Louisiana is also a great place to live if you are looking for low property taxes and affordable homes. Although the effective property tax rate in this state is 0.15 percentage points higher than in Alabama, the lower median home value accommodates this slight tax increase. Louisiana’s poverty rate (17.3%) is the second highest in the U.S., according to Statista.

Illinois Form 700 is one of the shorter state estate tax forms. But even though the estate exemption in Illinois is $4 million, you can still fall victim to it even if your Illinois assets are less than the exemption amount. For example if you are a non-resident , they can still be taxed in Illinois even if their Illinois assets are less than $4 million.

Property Tax Deduction: A Guide To Writing Off Real Estate Tax

Nevertheless, we thought it might help to list out a few key steps. Hawaii and Washington have the highest estate tax top rates in the nation at 20 percent. Eight states and the District of Columbia are next with a top rate of 16 percent. Massachusetts and Oregon have the lowest exemption levels at $1 million, and Connecticut has the highest exemption level at $9.1 million. Massachusetts and Oregon have the lowest exemption levels at $1 million, and Connecticut has the highest exemption level at $7.1 million.

Washington Property Owners May Contest 2022 Property Tax … – Mondaq News Alerts

Washington Property Owners May Contest 2022 Property Tax ….

Posted: Mon, 24 Apr 2023 12:13:47 GMT [source]

Manhattan topped that list, featuring an average tax of $42,627. In addition to the exemption possibilities listed above, you may be able to decrease your annual property tax in a couple of ways. The table below shows average property taxes by state, in alphabetical order.

Connecticut’s estate tax will have a flat rate of 12 percent by 2023. An estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs.

Check with the appropriate local services if you need help navigating the available programs. Currently, the tax only applies to the value of an estate in excess of $1 million. Under the prior law, it applied to the entire estate when it exceeded the $1 million threshold. Iowa is in the process of phasing out its inheritance tax, and will end it in 2025.

The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them. The total of all of these items is your “Gross Estate.” The includible property may consist of cash and securities, real estate, insurance, trusts, annuities, business interests and other assets. Keep in mind that the Gross Estate will likely include non-probate as well as probate property.

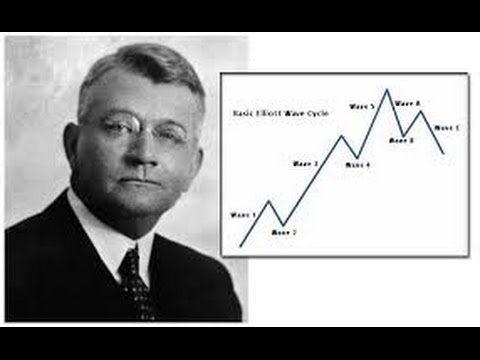

The History of the Estate Tax

Homeowners will be thrilled to hear that West Virginia features the lowest median home value on this list. Not only does this state feature affordable homes, but it also allows residents to enjoy the low effective property tax rate of 0.55%. The state also features lower everyday costs of groceries and transportation than many others in the U.S. Proponents note that abolishing the estate tax will result in tens of billions of dollars being lost annually from the federal budget.

This state’s median home value falls on the higher end of the scale compared to other states on this list — likely due to its many beach-front homes. Depending on where you live in the U.S., your property taxes might barely make a dent in your budget; or, they might be just as high as your rent or mortgage. The benefits of living somewhere with low property taxes are that monthly home payments are lower, making payments less of a burden and home ownership more affordable.

States With Estate Tax or Inheritance Tax, 2021 – Tax Foundation

States With Estate Tax or Inheritance Tax, 2021.

Posted: Wed, 24 Feb 2021 08:00:00 GMT [source]

In Schedule A of the return, list the estates U.S. assets, but show no values for those that are exempt from U.S. estate tax pursuant to a treaty. Attach a statement to the return that refers to the particular treaty applicable to the estate, and write that the estate is claiming its benefits. Entries for the gross estate in the U.S., the taxable estate, and the tax amounts, should be “0” if all of the decedents U.S. assets are exempt from U.S. estate tax pursuant to the applicable treaty. Attach to the Form 706-NA a copy of the return filed with the treaty partner.

Explore our weekly state tax maps to see how your state ranks on tax rates, collections, and more. Estate taxes are paid by the decedent’s estate before assets are distributed to heirs, and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest, and are thus based on the amount distributed to each beneficiary. Spouses are exempt from paying the inheritance tax in all six of these states, and some states extend that exemption, at least partially, to all immediate relatives.

Property taxes are calculated based on your local tax rate and your property’s value. Your local assessor will determine your home’s assessed value, which is likely to be less than its fair-market value. Property taxes can be reassessed annually, but some municipalities adjust their rates only once every few years. You will want to check with your city or county assessor’s office for more information on the frequency of property tax calculation.

- A large estate might face double taxation at the federal level – the regular estate tax followed by the income tax on the IRD.

- Many states collect just one type of tax—an estate tax or an inheritance tax.

- As noted above, life insurance benefits may be included in the gross estate (even though the proceeds arguably were not “owned” by the decedent and were never received by the decedent).

- Massachusetts and Oregon have the lowest exemption levels at $1 million, and Connecticut has the highest exemption level at $9.1 million.

They start at 8% and goes up to 16%, depending on the size of the estate. You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply. Estate planning can be complex, and that’s especially true if you’re someone with significant wealth. To make sure you have everything you need, read up on the essentialestate planning tools for wealthy investors.

Comentarios recientes